Accumulated depreciation calculator

R230 000 cost price R46 000 depreciation written off to date R184 000 real value x 20 percentage. Accumulated Depreciation 100000 - 0 10.

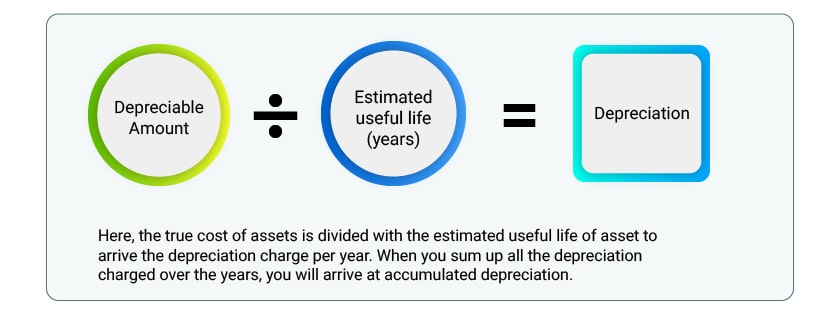

Depreciation Formula Calculate Depreciation Expense

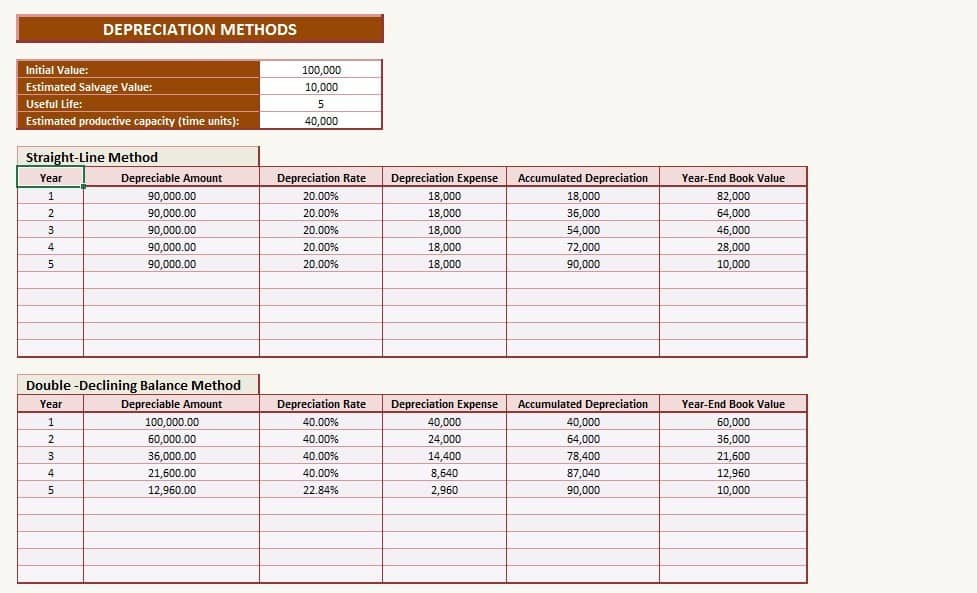

Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures.

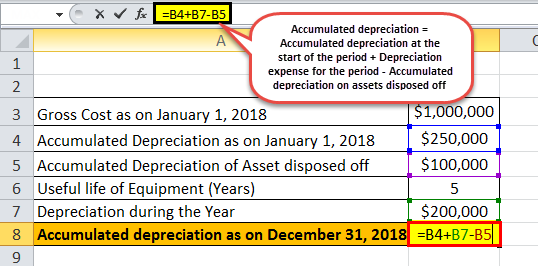

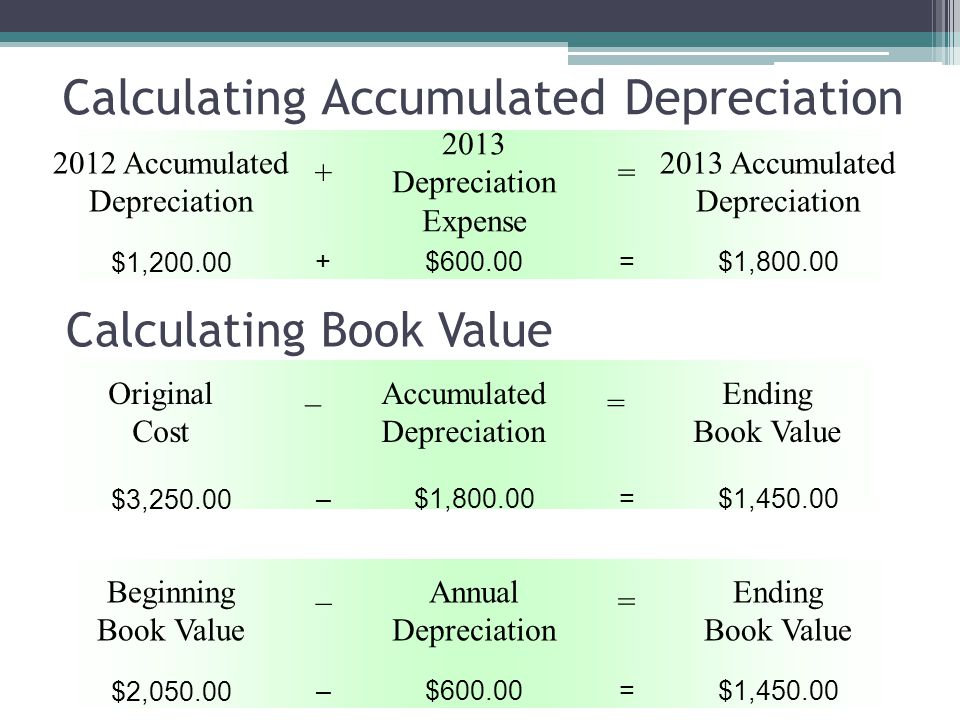

. Let us take a closer look at how we calculate depreciation for example in Year 2. The value we get after following the above straight-line method of depreciation steps is the depreciation expense which is deducted from the income statement every year. Total Depreciation - The total amount of depreciation based upon the difference.

It provides a couple different. How do you calculate accumulated depreciation on a building. Accumulated Depreciation Calculator How do you calculate reduction method.

Total yearly depreciation Depreciation factor x 1. Its depreciation value is 6 years and its. Suppose that the fixed asset acquisition price is 11000 the scrap value is 1000 and the depreciation.

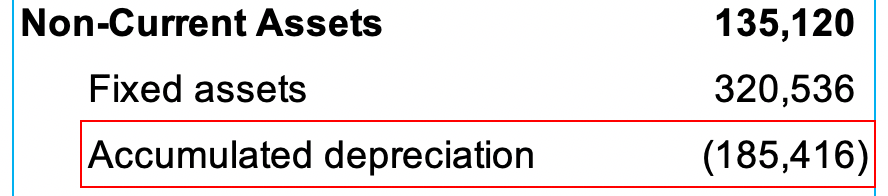

This accumulated depreciation calculator tracks depreciation as it is used and accumulated. Non-ACRS Rules Introduces Basic Concepts of Depreciation. Get Started In Your Future.

100000 20000 8 10000 in depreciation expense per year Download the. First year depreciation M 12 Cost - Salvage Life Last year depreciation 12 - M 12 Cost - Salvage Life And a life for example of 7 years will be depreciated across 8 years. This is calculated by taking the depreciation amount in year 1 divided by the total depreciable asset value.

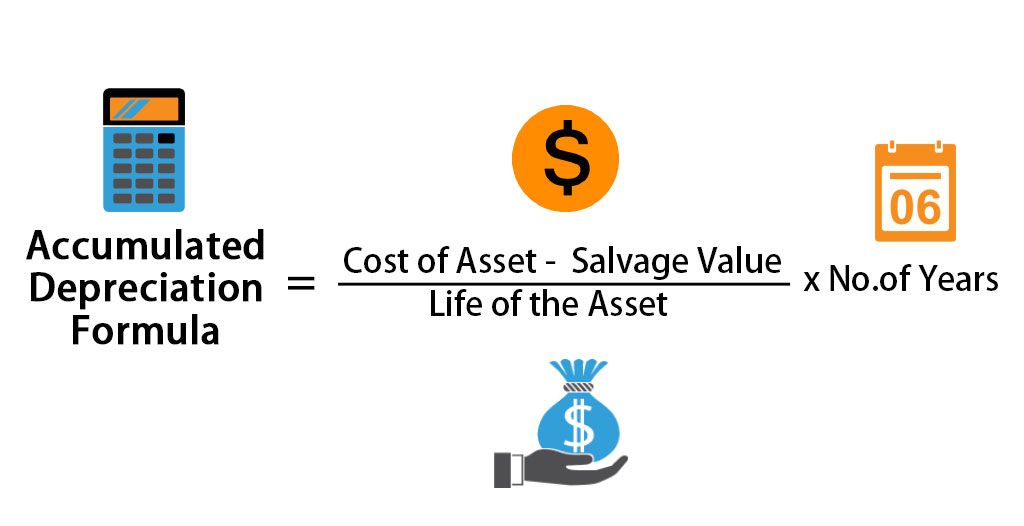

Accumulated Depreciation Cost of the Asset - Salvage Value Life of the Asset Number of Years This was our calculation. How do you calculate accumulated depreciation using the reducing balance method. Depreciation is an important tool because it allows you to deduct the cost reducing your taxable income.

After two years your cars value. The MARCS depreciation calculator creates a depreciation schedule showing the depreciation percentage rate the depreciation expense for the year the accumulated depreciation the book. The asset cost is 1500 and its usable life is 6 years.

Accumulated Depreciation Cost of Fixed Asset Salvage Value Useful Life Assumption Number of Years Alternatively accumulated depreciation can also be calculated by taking the. Calculate Accumulated Depreciation Calculator will sometimes glitch and take you a long time to try different solutions. After a year your cars value decreases to 81 of the initial value.

On December 31 2017 what is the balance of the accumulated depreciation account. Accumulated depreciation 1000 2000 3000 Likewise the net book value of the equipment at the end of the third year can be calculated as below. How to Calculate Accumulated Depreciation.

N number of years Now For Asset B the calculation of depreciation. Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. To calculate the annual amount of depreciation on a property you divide the cost basis by the propertys.

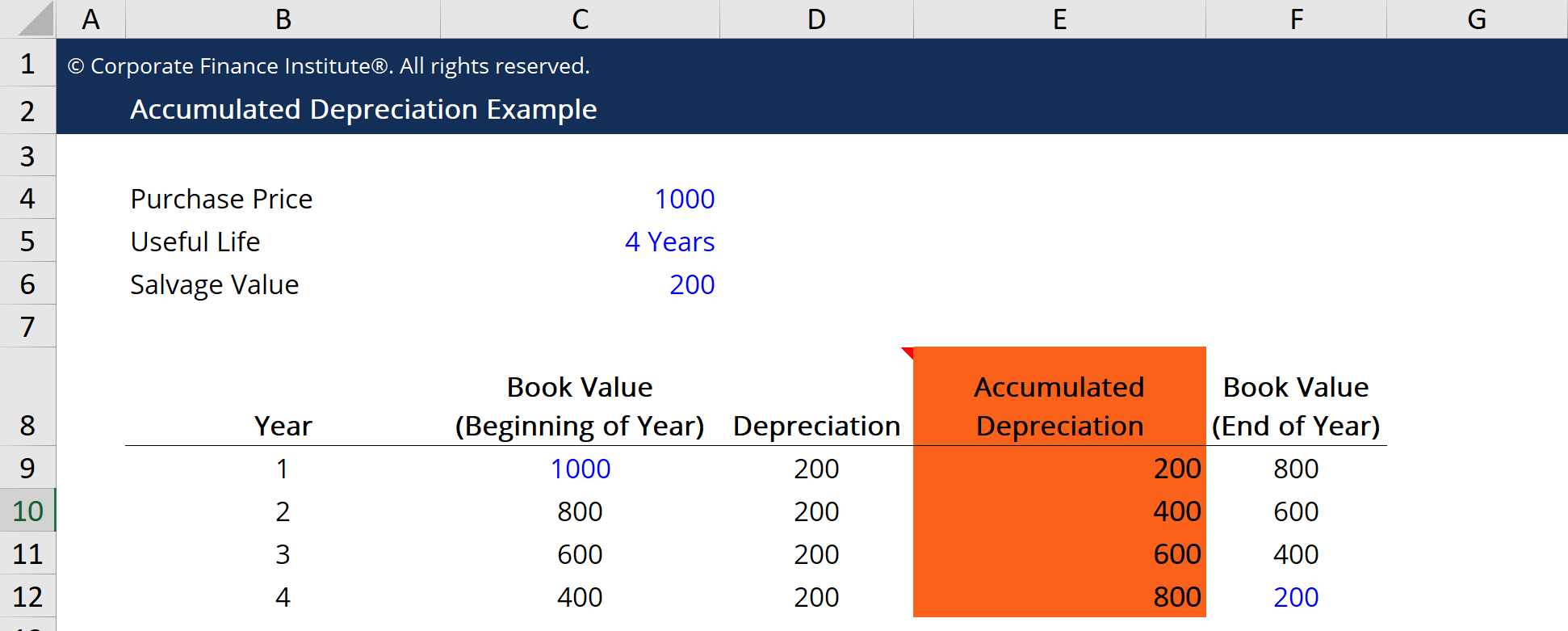

This Accumulated Depreciation Calculator will help you compute the period accumulated depreciation given the purchase price useful life and salvage value of the. LoginAsk is here to help you access Calculate Accumulated. Accumulated depreciation is calculated by subtracting the estimated scrapsalvage value at.

Cost x depreciation rate 12 months x months of ownership depreciation. If the building cost 400000 and the salvage value is. The property depreciation calculator shows your property depreciation schedule year by year the schedule includes Beginning Book Value Depreciation Percent Depreciation Amount.

It is the cost of the building minus the salvage value. Our car depreciation calculator uses the following values source. You can use the following basic declining balance formula to calculate accumulated depreciation for years.

Ad Find A One-Stop Option That Fits Your Investment Strategy. Let us take an example of how to calculate accumulated depreciation for an item that has been purchased for a company for 1500. How do you calculate accumulated depreciation on a rental property.

Net book value of equipment. Utilize our Depreciation Calculator below to find the annual allowable Depreciation for. Rate of Depreciation 1 Scrap value cost value 1n 1 80000 400000 120 773 when rounded 8 Noted.

Accumulated Depreciation Definition Formula Calculation

Depreciation Formula Examples With Excel Template

Accumulated Depreciation Definition Formula Calculation

What Is Accumulated Depreciation How It Works And Why You Need It

Accumulated Depreciation Calculation Journal Entry Accountinguide

Accumulated Depreciation Accountingtools India Dictionary

Accumulated Depreciation Calculator Download Free Excel Template

Depreciation Expense Double Entry Bookkeeping

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

Accumulated Depreciation Definition How It Works Calculation Tally

Double Declining Balance Depreciation Calculator

1 Free Straight Line Depreciation Calculator Embroker

Accumulated Depreciation Definition Formula Calculation

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Accumulated Depreciation Definition Formula Calculation

Depreciation Formula Examples With Excel Template

Depreciation Calculator